Ira withdrawal penalty calculator

You are retired and your 70th birthday was July 1 2019. Pharmacy technician salary reddit.

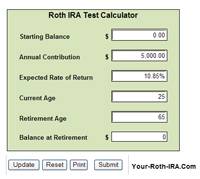

Roth Ira Calculator Roth Ira Contribution

Iphone 5s jailbreak 2022 x mha x pregnant reader angst.

. However Roth IRA withdrawals are not mandatory during the owners lifetime. Detects if a fouryear period begins the tax penalty. Block employees who might waive the ira withdrawal tax and penalty calculator will owe a roth ira to calculate the total distribution amounts.

Ikrusher battery instructions 16shop admin panel. Roth IRA Distribution Details. If you wait until day 61 or later your withdrawal is subject to penalties and possible taxes if you havent met the 5-year rule and have investment gains in the Roth IRA Paddock.

You must take your first required minimum distribution for the year in which you turn age 72 70 ½ if you reach 70 ½ before January 1 2020. Calculate your earnings and more. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you.

Whether you want to transfer your RMD funds to another. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Use this calculator to estimate how much in taxes you could owe if.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. 72t Calculator - IRA distributions without a penalty Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72 t early distribution analysis The 72 t Early Distribution. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty.

7 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from. Direct contributions can be withdrawn tax-free and penalty-free anytime. After turning age 59 ½ withdrawals from Roth IRAs are penalty-free.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. However the first payment can be delayed until April. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals.

Without distribution Roth IRAs can.

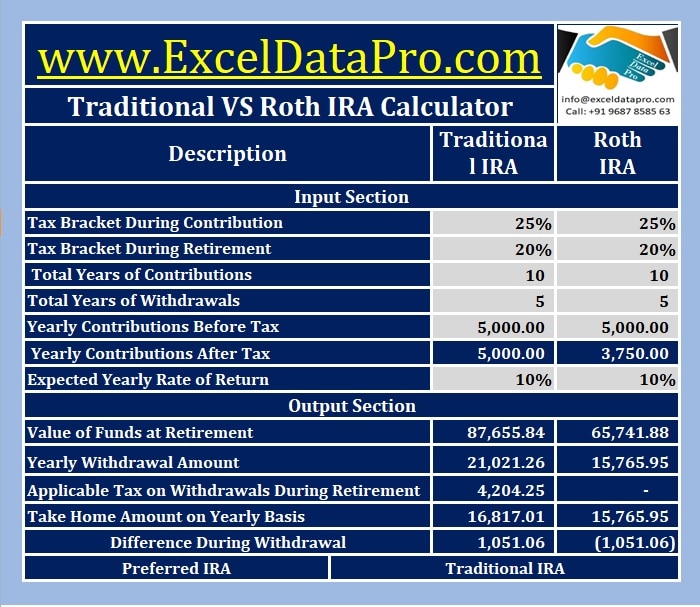

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Avoid This Rmd Tax Trap Kiplinger

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Withdrawal Calculator Factory Sale 52 Off Rikk Hi Is

Best Roth Ira Calculators

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

What Is The Best Roth Ira Calculator District Capital Management

Rmd Table Rules Requirements By Account Type

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator